A Brief Summary Of Medicare Supplement Insurance (Medigap)

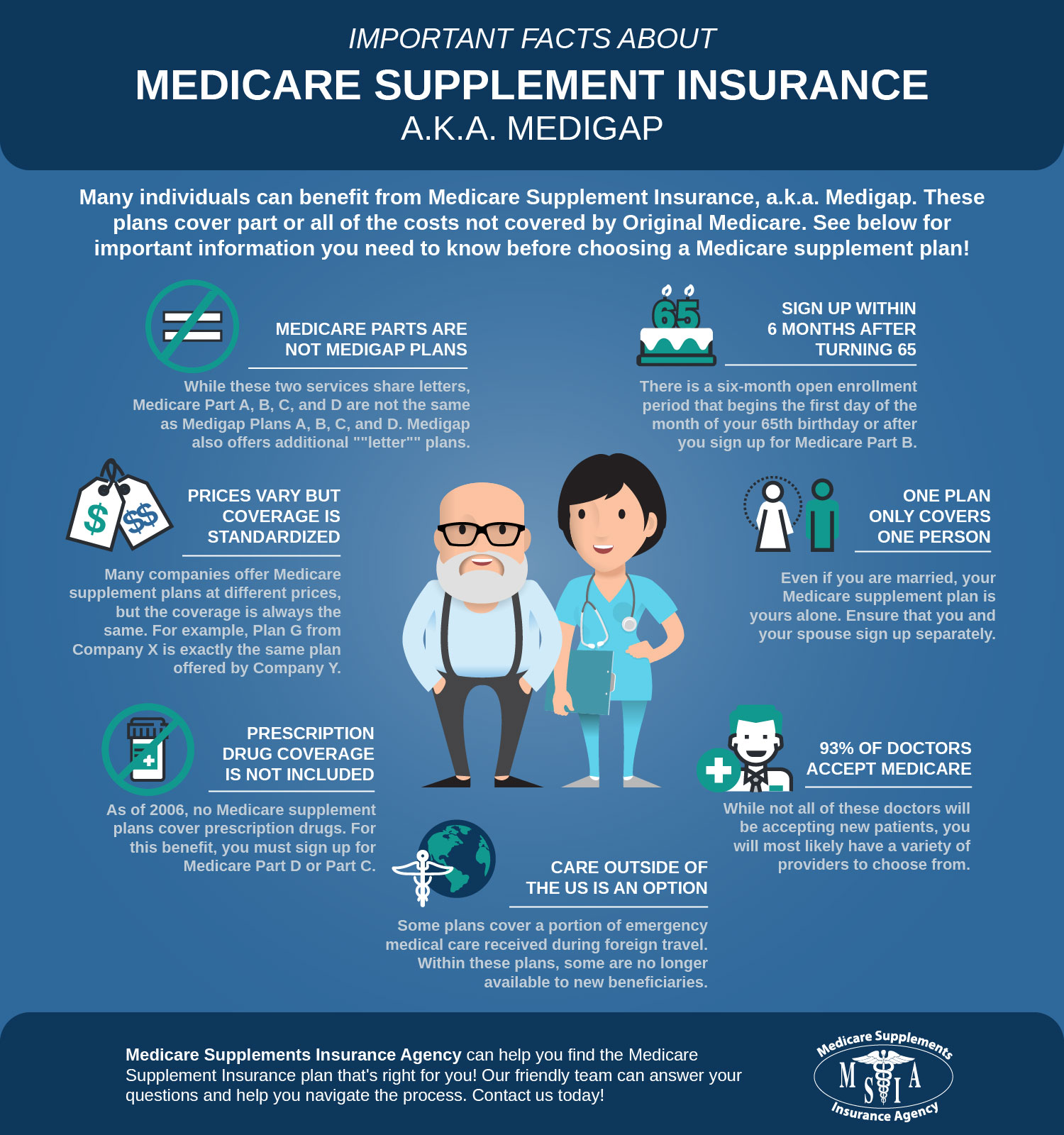

Being prepared for the financial impacts of your emergency and routine health care services is a crucial component of maintaining your livelihood. If you’re 65 or older and have Medicare Part A and Medicare Part B (together called “Original Medicare“), adding a Medicare supplement plan will help cover some of the health care costs that Original Medicare doesn’t pay for, such as copayments, coinsurance, and deductibles. Before you sign up for a Medicare supplement/Medigap policy, there are a few important things to know. We’ll share them with you below!

At Medicare Supplements Insurance Agency, we are passionate about making it easy for you to get the information you need about Medicare supplement plans (also called Medigap). Our knowledgeable team is standing by to answer your questions and help you choose the right plan for your needs. Contact us today!

Medicare Parts Are Not Medicare Supplement Plans

Medicare options include Part A, B, C, and D. These are not the same as any of the Medicare supplement plans, although there are plans that share letters. There are 10 Medicare supplement plans to choose from*: Medigap Plans A, B, C, D, F, G, K, L, M, and N. Each plan offers different levels of coverage for a variety of health care service costs. You can compare available Medicare supplement plans on our comparison page! All Medicare insurance carriers are required to offer Plan A. Again, it’s important not to confuse Medicare Part A, B, C, or D with Medigap Plan A, B, C or D.

*Plan F and Plan C will no longer be available to new Medicare beneficiaries starting January 1, 2020.

When Can I Buy A Medicare Supplement Plan?

Open enrollment for Medicare Supplement Insurance plans begins on the first day of the month of your 65th birthday or after signing up for Medicare Part B. The enrollment period is six months in both cases. You can purchase a Medicare supplement plan within this window for the same price, whether you are in good or poor health. It’s important to sign up for a Medicare Supplement Insurance plan during open enrollment, or you risk a denial of coverage or higher rates if you do get coverage.

Medicare Supplement Plan Prices May Vary, But The Coverage For Each Plan Is Standardized

Even though Medigap Plan A from one company may cost more than from another company, the benefits it provides will always be the same. This makes it easier to shop for the right policy and compare your options. The Annual Rate Review Service we offer here at Medicare Supplements Insurance Agency is a great way to ensure you’re getting the best deal on the plan you need. You can start this process now by filling out a simple online form!

Quick Facts About Medicare Supplement Plans (Medigap)

- You need Medicare Part A and Part B to qualify.

- Medigap policies require a monthly premium paid to a private insurance company.

- A Medigap policy only covers one person, regardless of marital status.

- Your plan can’t be cancelled by the insurance company as long as you pay the premium, regardless of health problems.

- You can buy a Medigap plan from any licensed state insurance company.

- Medigap plans sold after January 1, 2006 do not include prescription drug coverage.

Can I See Any Doctor If I Have A Medicare Supplement Insurance Plan?

The great thing about all Medicare Supplement Insurance policies is that they allow you to see any doctor that participates in Medicare! You don’t have to worry about where you bought your plan from, because the plans are standardized among all insurance companies. According to a 2015 study, 93% of doctors accept Medicare patients — but not all of them were accepting new patients at the time. Keep in mind that this acceptance does not apply to Medicare Advantage plans — only Original Medicare (Part A and Part B).

Does Medigap Cover Care Outside Of The United States?

Some Medigap plans offer foreign travel emergency coverage with a lifetime limit of $50,000. These plans will cover emergency care that begins within the first 60 days of an international trip, if Medicare does not cover the care. When you meet the yearly $250 deductible, these Medigap plans will pay for 80% of the billed charges incurred by medically necessary emergency care. The Medigap plans that apply to this benefit are Medigap Plans C, D, E, F, G, H, I, J, K, M, and N. Note that Plans E, H, I, and J are no longer available to new Medicare beneficiaries, and Plans C and F will no longer be available for new beneficiaries starting January 1, 2020.

We Can Help You Shop For A Medicare Supplement Plan

At Medicare Supplements Insurance Agency, we help the people of North Carolina and South Carolina find the best Medicare supplement (Medigap) plan for their needs at the best price available. Our mission is to ensure that you have a smooth experience choosing your supplement, from comparing plan benefits and coverage to feeling comfortable with your final decision. You can start the process today by contacting our team using this online form. We can’t wait to serve you!